The latest numbers from the wine industry are hard to believe. In talking with a few people I know, these reactions/ideas were kicked-around:

Direct To Consumer Wine Sales Numbers for 2025

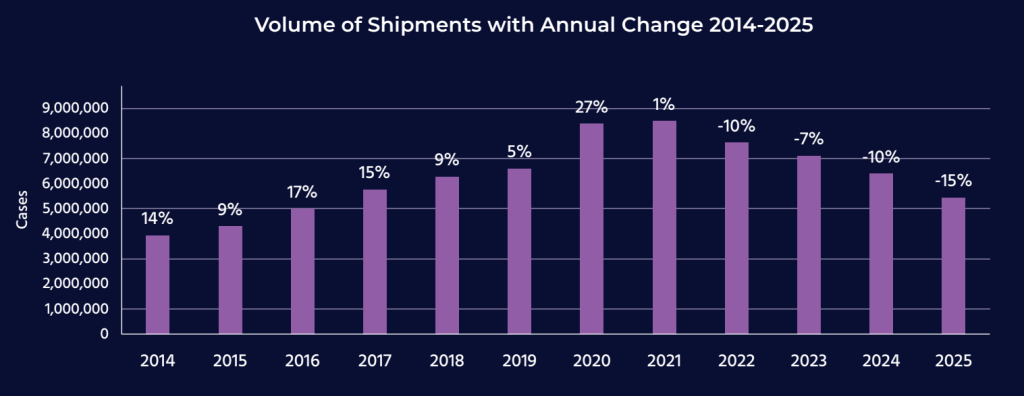

The speed at which demand destruction is changing the wine, beer and spirits industry is hard to comprehend. Keep in mind, CA sells about 75% of all U.S. wine. DTC (direct-to-consumer) wine sales from CA, excluding the Napa AVA, have dropped almost 50% since 2021. 2025 CA DTC sales without the Napa AVA dropped 32%. Napa sales were roughly flat. See direct excerpts from the Sovos DTC Wine Report for 2025 below.

- “This year’s DTC data shows that no obvious bottom emerged in 2025, as the year over-year changes in both volume and value of DTC shipments saw record decreases of 15% and 6%, respectively. Moreover, after three years of smaller increases in average bottle prices, 2025 saw a significant 11% increase in average price per bottle shipped, to a record $56.78. 2025 was the most disappointing year for DTC wine shipments since this report was first published in 2010. All told, in 2025 the DTC shipping channel retreated by more than 967,000 cases and gave up over $230 million.”

- “Only one region, Napa, eked out a gain in value of shipments at 1%. The Rest of California region experienced a drop in volume of 32%, resulting in a 47% decline in the volume of shipments from Rest of California since 2021.”

Media reports are estimating, roughly 50% of the wine grapes grown in CA last year were not harvested. If confirmed, there will be a U.S. bulk wine fruit/juice shortage in 2026, unless consumption continues to drop. The latest harvest numbers are showing the industry is planning for a continuing major drop in consumption.

Effect on the Typical Wine Enthusiast

What impact does this suggest for the premium wine consumer? The current world trend seems to be “drink less, but better”. In my opinion:

- Total wine consumption in the U.S. was down 2% again in 2025 (more in other countries), but as you see above, DTC was hit much harder. **This will put pressure on smaller wineries without commercial distribution to find ways to get closer to customers. Keep an eye out for good things from your favorite smaller wineries.**

- For those of us that are buying for their cellar… **keep an eye out for flash sales / dropping auction prices for quality labels at distressed prices, in the short term.**

- The price impact on higher quality wines in each price category will be less. Demand for trained, experienced premium winemakers will be high. **Follow your favorite winemakers as they move.**

- In the longer run, it will take time for the major premium/luxury labels of the world to right-size production and inventory. **When that finally happens, I would expect premium/luxury wine prices will rise.**

- For wines at or below the average premium U.S. bottle price, sales are likely to fall substantially… until the U.S. market stabilizes. **This will soften current wine prices generally. ** U.S. wine growers will get a short-term shot-in-the-arm from the pending new statute requiring wines labeled with U.S. AVAs to discontinue the use of up to 25% imported bulk wine. Tariffs will continue to effect import wine prices… **further squeezing labels depending on exports to the U.S.**

- These numbers are not a catastrophe. U.S. wine sales were still estimated at about $70B in 2025. Although, the weakening high-profit DTC channel was previously helping prop-up the industry. This will drive changes impossible to predict at this point.

Interesting times ahead!